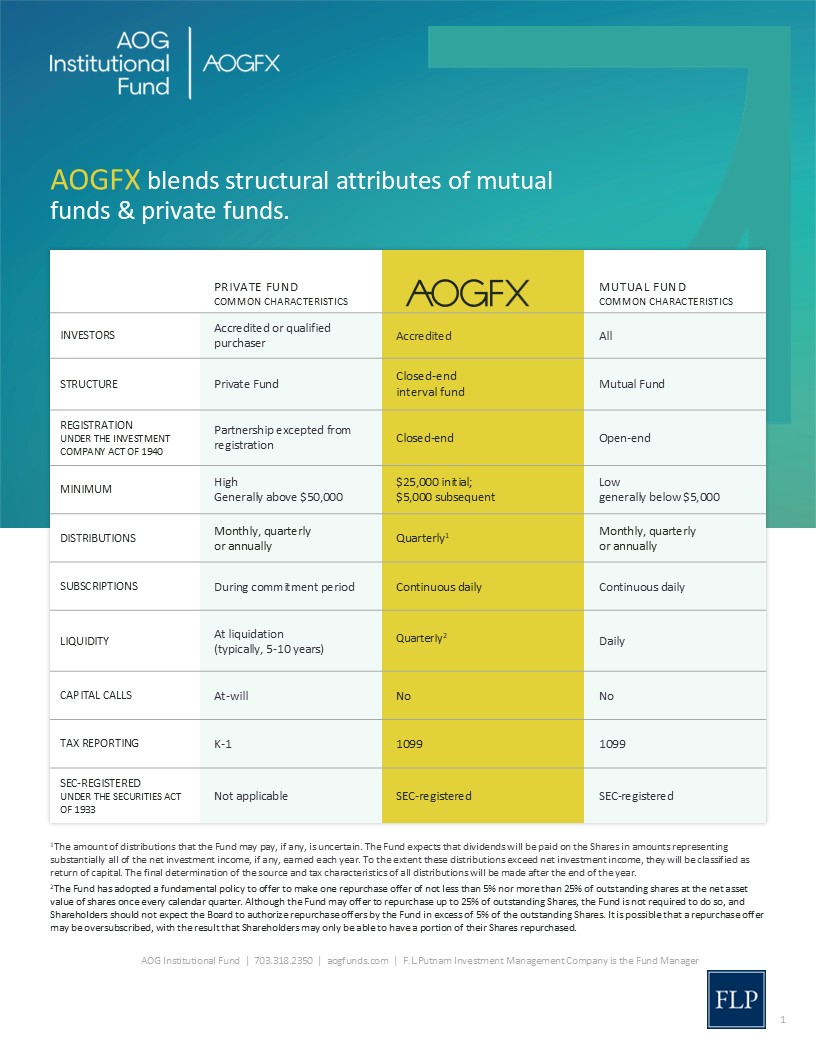

AOGFX blends structural attributes of mutual funds & private funds.

| wdt_ID | Private Fund: Common Characteristics | Mutual Fund: Common Characteristics | ||

|---|---|---|---|---|

| 1 | Investors | Accredited or qualified purchaser | Accredited | All |

| 2 | Structure | Private Fund | Closed-end interval fund | Mutual Fund |

| 3 | Registration Under the Investment Company Act of 1940) |

Partnership excepted from registration | Closed-end | Open-end |

| 5 | Minimum | High Generally above $50,000 |

$25,000 initial; $5,000 subsequent |

Low generally below $5,000 |

| 6 | Distributions | Monthly, quarterly or annually | Quarterly1 | Monthly, quarterly or annually |

| 7 | Subscriptions | During commitment period | Continuous daily | Continuous daily |

| 8 | LIQUIDITY | At liquidation (typically, 5-10 years) |

Quarterly2 | Daily |

| 9 | Capital Calls | At-will | No | No |

| 10 | Tax Reporting | K-1 | 1099 | 1099 |

| 11 | SEC-Registered Under the Securities Act of 1933 |

Not applicable | SEC-registered | SEC-registered |

1The amount of distributions that the Fund may pay, if any, is uncertain. The Fund expects that dividends will be paid on the Shares in amounts representing substantially all of the net investment income, if any, earned each year. To the extent these distributions exceed net investment income, they will be classified as return of capital. The final determination of the source and tax characteristics of all distributions will be made after the end of the year.

2The Fund has adopted a fundamental policy to offer to make one repurchase offer of not less than 5% nor more than 25% of outstanding shares at the net asset value of shares once every calendar quarter. Although the Fund may offer to repurchase up to 25% of outstanding Shares, the Fund is not required to do so, and Shareholders should not expect the Board to authorize repurchase offers by the Fund in excess of 5% of the outstanding Shares. It is possible that a repurchase offer may be oversubscribed, with the result that Shareholders may only be able to have a portion of their Shares repurchased.

Important Information

An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Fund’s prospectus. To obtain a prospectus, please 703.318.2350 or visit aogfunds.com. Please read the prospectus carefully before investing.

Investment in the AOG Institutional Fund (“AOGFX Fund”) is speculative and involves substantial risks, including the risk of loss of a Shareholder’s entire investment. Investors may not have immediate access to invested capital for an indefinite period of time and must have the financial ability, sophistication/experience, and willingness to bear the risks of an illiquid investment. No public market for Shares exists, and none is expected to develop in the future. An investor’s participation in the Fund is a long-term commitment, with no certainty of return. No guarantee or representation is made that a Fund will achieve its investment objective, and investment results may vary substantially from year to year. Additional risks of investing in the Fund are set forth below.

Additional Comparison Considerations

Before making an investment decision, it’s important to check the fund’s prospectus or offering memorandum for factors such as investment objectives, costs and expenses, liquidity, fluctuation of principal or return, and tax features. Investment objectives will vary greatly among all structures and directly impact the volatility of any given fund, however private market funds are generally expected to be more speculative than registered funds due to the differences in regulatory oversight requirements. While mutual funds are limited in the amount of illiquid and derivative investments they may make, closed-end funds have less limitations, and private funds generally have no restrictions on such holdings. The performance of private market funds is difficult to measure and therefore such measurements may not be as reliable as performance information for other investment products. In addition to the transactional fees and ongoing operating expenses contained within most fund structures, private market funds often include a performance fee applicable to investors.

Investing involves risk and principal loss is possible. This is being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. Any examples used in this material are for illustration purposes only. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor’s own situation.

Additional Risk Considerations

Certain risk factors below discuss the risks of investing in Private Markets Investment Funds.

Real Estate Securities Risks. The value of companies investing in real estate is affected by, among other things: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties;(iii) risks related to local economic conditions; overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates.

REIT Risk. There can be no assurance that the entities in which the Fund invests with the expectation that they will be taxed as a REIT will qualify as a REIT, and such a failure could significantly reduce the Fund’s yield on that investment.

Derivatives Risk. The Fund and certain Investment Funds may invest their assets in derivatives, such as futures, forwards and options contracts, which may be illiquid and have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates, and currency exchange rates.

Credit Risk. There is a risk that debt issuers will not make payments, resulting in losses to the Fund, and default perceptions could reduce the value and liquidity of securities and may cause the Fund to incur expenses in seeking recovery of principal or interest on its portfolio holdings. Lower-quality bonds, known as “high yield” or “junk” bonds, present a significant risk for loss of principal and interest and involve an increased risk that the bond’s issuer, obligor or guarantor may not be able to make its payments of interest and principal.

Restricted and Illiquid Investments Risk. Particular investments of the Fund or Investment Fund may be difficult to sell at an advantageous price or at all, possibly requiring the Fund or Investment Fund to dispose of other investments at unfavorable times or prices to satisfy its obligations. Investment Funds with principal investment strategies that involve securities of nontraded REITs, companies with smaller market capitalizations, derivatives or securities with substantial market and/or credit risk tend to have the greatest exposure to liquidity risk.

Private Markets Investment Funds. The managers of the Private Investment Funds in which the Fund may invest may have relatively short track records and may rely on a limited number of key personnel. The portfolio companies in which the Private Investment Funds may invest also have no, or relatively short, operating histories, may face substantial competitive pressures from larger companies, and may also rely on a limited number of key personnel. The Fund will not necessarily have the opportunity to evaluate the information that a Private Investment Fund uses in making investment decisions.

Competition. The business of investing in private markets opportunities is highly competitive, uncertain, and successfully sourcing investments can be problematic given the high level of investor demand some investment opportunities receive. There are no assurances that the Fund will be able to invest fully its assets or that suitable investment opportunities will be available.

Distressed, Special Situations and Venture Investments. Investments in distressed companies and new ventures are subject to greater risk of loss than investments in companies with more stable operations or financial condition.

Multiple Levels of Expense. Shareholders will pay the fees and expenses of the Fund and will bear the fees, expenses and carried interest (if any) of the Investment Funds in which the Fund invests.

The AOG Institutional Fund is distributed by Distribution Services, LLC which is not affiliated with F.L.Putnam Investment Management Company.